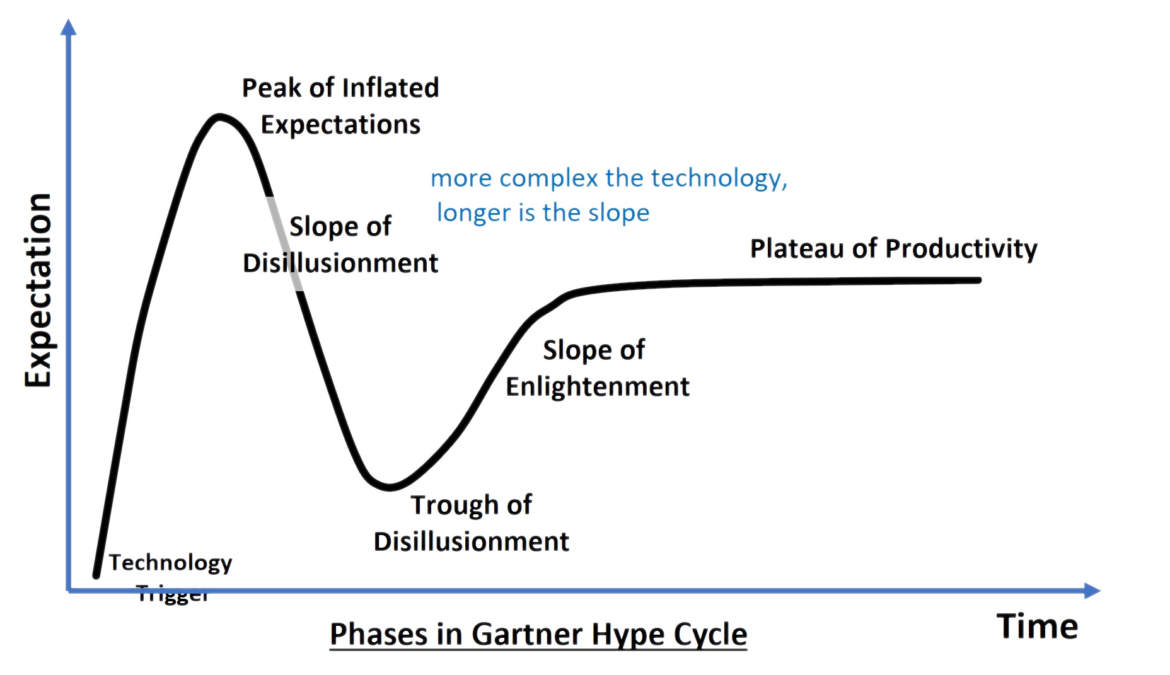

The Gartner Hype Cycle has been a useful framework for accurately reflecting the progression and regression—the ups and downs—of technology development (see Fig 1). A technology must “evolve” and follow its course before it can reach functional reality and achieve commercial success. For example, the idea of electroluminescence was explored by a Russian scientist in the 1930s, leading to the invention of first LED light in 1960 through research at Texas Instruments and General Electric. It took decades to work out all the kinks before LED lighting and displays became ubiquitous and commercially successful.

The more complex a technology, the longer it takes to reach the “plateau of productivity”. In some cases, the complexity and subsequent anticipation may lead to a wave of cycles rather than a straightforward crest and trough of development.

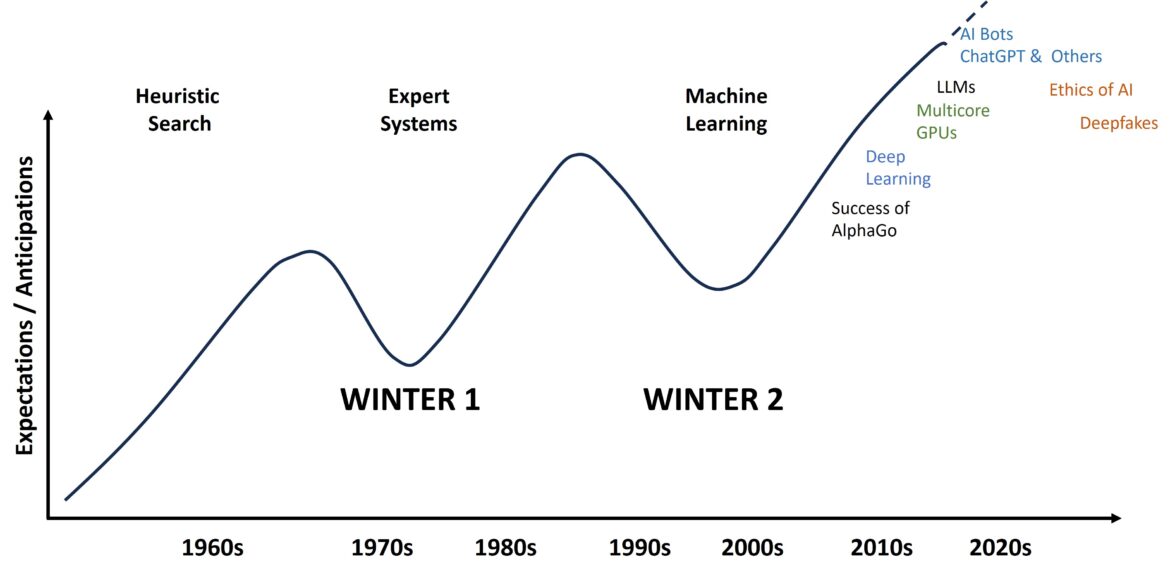

AI is a great case in point.

The ups and downs of hope and anticipation, the ebb and flow of funding, and the tension between disillusionment and progress have been a continuous pattern in the development of artificial intelligence over the last sixty or seventy years. This has given rise to the term “AI Winter,” when funding and research investment temporarily paused due to the lack of fruition from over-hyped promises, only to usher in new rounds of development—the so-called “AI Spring”—when the limitations of the technology are worked out, supported by fresh advances in computational technology.

Despite the current state of AI development and the proliferation of AI applications today, it is possible that the cycle may still experience its ebbs and flows. There are discussions about the AI bubble, the need for ethical AI, and addressing the challenges posed by deepfakes. One could argue that despite the ongoing success of generative AI (Gen-AI) and large language models (LLMs), the technology still has many steps to go. For example, it must improve the inefficient, brute-force, high-energy-consuming computations even for simple queries or basic tasks. ChatGPT, one of the more popular AI chatbots, reportedly consumes about 0.5 million kWh of electricity per day on average for every 200 requests. Other estimates suggest that an average simple chatbot query may require the equivalent cooling of a full bottle of water. Clearly, the technology needs progress.

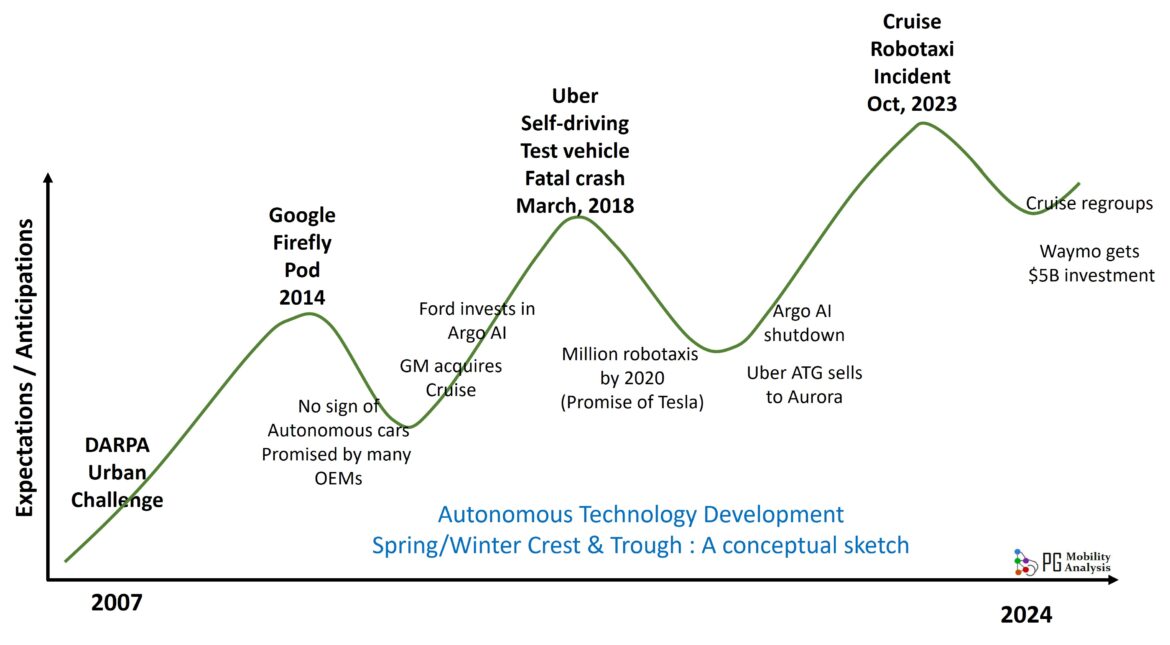

What about autonomous technology and self-driving cars?

Autonomous technology for ground transportation, which depends partly on AI for its execution, is a relatively new discipline, less than two decades old. Since the first Defense Advanced Research Projects Agency (DARPA) Grand Challenge in 2004 and the Urban Challenge in 2007, self-driving technology has already gone through several cycles of crests and troughs due to missed targets and fluctuations in investment.

The first wave

The so-called self-driving hype cycle possibly saw its first peak in 2014, with Google showcasing its autonomous pod concept, Firefly, without a pedal or steering wheel. Media, investment bankers, and others predicted that we would be riding in commercial robotaxis very soon, with most major car manufacturers launching autonomous development programs. There was a plethora of autonomous “shuttle” concepts around the globe. However, despite many media proclamation, Firefly did not result in any immediate functioning robotaxis in the market, nor did any original equipment manufacturer (OEM) produce anything remotely close to that concept, triggering the first disillusionment of the autonomous cycle.

The second wave

The rise of Uber (followed by Lyft), with its breakthrough app connecting riders anywhere with a crowdsourced willing driver, added new enthusiasm to the dream of taking its taxi service further, raising the possibility of ride-hailing robotaxis. Uber decided to go all out to pursue its robotaxi dream by creating Uber Advanced Technology Group (ATG) and recruited every available AV or robotics professional, practically gutting Carnegie Mellon University’s robotics lab’s research team. General Motors acquired Cruise in 2016 for a reported $1 billion, and Ford invested in Argo AI.

The second peak of the autonomous hype came around early 2018 and then hit the brakes after a Uber ATG test vehicle fatally struck a pedestrian in Arizona. The accident cut short the unbridled enthusiasm, injecting a much-needed dose of caution and a better sense of the complexity involved in developing self-driving technology. This event was a watershed moment that decelerated the rush to launch self-driving vehicles, temporarily choking the flow of venture capital. The fatal crash catalyzed the dismantling of Uber ATG, with a temporary pause on Uber’s autonomous ambitions. The event also moderated the valuations of autonomous startups such as Waymo and Zoox. Zoox, after a valuation drop from $3.2 billion to $1.2 billion, was acquired by Amazon.

The cool down period

The cooling-down period that followed was not helped by Tesla’s misplaced claim to have a million robotaxis on U.S. roads by 2020. The subsequent years saw a spate of consolidations, closures, or liquidations of several startups, such as TuSimple, Embark, Starsky Robotics, Otto, and Peloton, many of them in the heavy-duty truck segment. This winnowed the field of autonomous trucking to a handful of players, namely Aurora Innovation, Kodiak, and Torc Robotics. There was also a narrowing down of robotaxi players, with Waymo, Cruise, and, to a lesser degree, Zoox emerging as the leading proponents. During these years, new players such as Wayve in the UK and Waabi in Canada also emerged, both with a strong AI focus.

There was also some awareness of incorporating road safety into autonomous software, such as Mobileye’s proposal of the Responsibility-Sensitive Safety (RSS) model, and Aurora’s Safety Case Framework and Autonomy Readiness Measure (ARM).

The third shake-up

The third shake-up of the industry perhaps came with the October 2023 accident involving a Cruise robotaxi that dragged an injured pedestrian who had been struck earlier by an adjacent vehicle. The event led to the suspension of Cruise’s operation, forcing it to reexamine its safety protocols. The idea of a “beta” release and the subject of robotaxi pilots and road safety gained renewed focus following the Cruise incident. However, there seems to be a return to some equilibrium in development and investment, with Alphabet committing a new $5 billion investment in Waymo during its Q2 2024 earnings call. Cruise has also received fresh investment of $850 million from GM as it regroups after the unfortunate pedestrian-dragging incident last October.

It is important to note that none of the ongoing pilots or their expansions should imply that the holy grail of commercial self-driving is just around the corner. Despite the progress, most test robotaxis occasionally cause traffic problems—running into utility poles, crawling onto wet cement, driving on the wrong side of the road, or colliding with parked vehicles. While these incidents might be considered routine during developmental testing, legitimate questions persist about “beta” testing these vehicles without safety drivers in live city traffic. It’s worth noting that while the majority of the robotaxi pilot rides are incident-free, Waymo continues to be under investigation by the NHTSA for at least 22 incidents involving crashes or other traffic violations.

Food for thought

Fully unsupervised autonomous driving (AV) in a dynamic urban environment is a very complex problem with many unforeseen edge cases. The technology needs time to live up to its promise of a collision-free future. We will wait to see how the hype cycle of autonomous development continues to progress through its spring and winter.

#Autonomous #Hypecycle #Selfdriving #AV #AI-winter #technology #waymo #GM #ford #cruise #beta #uber #transportation #mobility #trend